It’s That Time of Year For Section 179 Purchases

Every year just as sweater weather rolls around in both our Pennsylvania and Minnesota locations, our customers begin to ask about Section 179 – and the tax breaks available on qualifying equipment purchases. We’re happy to provide our readers with up-to-date information on this beneficial allowance as part of the IRS tax code. For those who are new in business or haven’t yet utilized this benefit, keep reading to learn more. And for our readers familiar with the code, we’re ready for you!

WHAT IS SECTION 179, AND WHO QUALIFIES?

The IRS’ Section 179 is practical for small to medium-sized businesses, allowing them to deduct the full purchase price of qualifying equipment bought or financed during the tax year (the end of the day on December 31, 2022), subtracted from the businesses’ gross income.

Under Section 179, companies can buy equipment (as a business expense). Parameters and benefits include:

- Both new and used machinery and vehicles are eligible (with some restrictions)

- The ability to buy more equipment during a calendar year

- Allowing businesses to make positive impacts on the US economy

There are no restrictions on the company size or type of company that can take advantage of the Section 179 tax credit.

WHAT ARE THE 2022 TAX BREAKS?

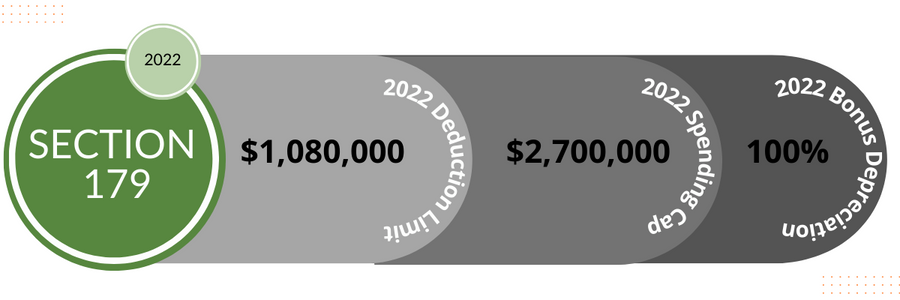

Each year since its inception, the parameters of Section 179 have included a deduction limit, a spending cap, and bonus depreciation. For 2022, the limits include the following:

WHAT IS MY SAVINGS POTENTIAL WITH SECTION 179?*

Every business is different, and equipment needs vary. Use the OCS Section 179 Calculator to determine your potential tax savings (based on your tax bracket) using Section 179.

WHY SHOULD I INVEST IN MY BUSINESS NOW?

Buying now (in 2022) can help your business this year and ensure you reap financial benefits come tax time. Section 179 is unique, allowing companies to be credited for the total purchase price of equipment rather than requiring depreciation over several years. So, you get the best of both worlds – buying the equipment you need to grow your business today and writing off 100 percent of the purchase price on your 2022 taxes.

WHAT ARE THE BENEFITS OF FINANCING WITH OCS?

If you’re interested in purchasing equipment before the end of the year, get pre-approved today! Our finance professionals are happy to guide you through our streamlined process so you can quickly buy the equipment you need to run your business and qualify for Section 179. By financing equipment for your business, you can reserve cash flow while taking advantage of the Section 179 tax benefit – it’s a no-brainer!

Here are some perks of working with our experienced team:

- DIRECT LENDER

- FAST APPROVALS

- QUICK AND SEAMLESS FUNDING PROCESS

- NO MONEY DOWN

- NEW + USED EQUIPMENT FINANCING

- TITLED AND NON-TITLED EQUIPMENT

- E-DOCS + REMOTE ONLINE NOTARY

- STRUCTURED TERMS AVAILABLE FOR TROUBLED CREDIT

- DELAYED PAYMENT OPTION

Contact an OCS finance professional any time at 877-701-2391 or ocs@oakmontfinance.com. Ready to apply today? Click here to get started on our 5-minute application.

Curious about what the previous year’s benefits looked like under Section 179? Check out the links below:

Section 179 Deductions for 2021

Section 179 Deductions for 2020

Section 179 Deductions for 2019

Section 179 Deductions for 2018

*Limitations and restrictions may apply. This information is not intended to provide tax or legal advice. Consult your tax advisor or tax attorney regarding Section 179 and the specific impact on your business. Financing based on credit approval. Not all finance agreements can take advantage of Section 179 tax incentives.

WHY CHOOSE US?

Better Rates and Flexible Terms

Over 20 Years of Experience

24 Hour Turnaround